Grocery Update #61: The Tariff Shell Game.

Also: Albertsons' Tariff-Related Price Increase Policy.

Discontents: 1. Tariff Shell Game. 2. Albertsons’ Tariff Pricing Letter. 3. Tunes.

1. The Tariff Shell Game.

I was not going to write about tariffs. One, because everyone else is. Two, because the situation keeps devolving. Three, because I keep writing about Don Cheeto and the impacts His Highness’ new policies will have on our food supply, the vast majority of which are really, really not good, even though I think GRAS is bullshit too and no one needs artificial food dyes. It gets tiresome. I just want to go to grocery stores, buy food, take pictures, write about assortments, prices, end-caps and planograms, and make bad jokes. I promise I will again, soon. But tariffs. JFC. So here goes.

1. Disclaimer: I have worked with dozens of importers and with thousands of imported products, branded and private label, on both sides of the buying desk, mostly as a category manager, grocery V.P. and a bit as a brand founder, consultant and advisor. Tariffs are usually just normal, boring grocery math. Not today, though.

2. Normal tariffs: Typically the importer of record pays the tariff of the product being imported from the country in question (China, Italy, Japan, Lesotho, the Penguin Islands, etc.) to the U.S government, and either includes the tariff in the cost of goods of the product as an additional layer of cost (like trade spend, advertising, labor, manufacturing line time, ingredients, logistics, wholesale billbacks, etc.) or the importer absorbs it and lowers their overall gross margin and, potentially, profit margin. The host country does not pay the tariff. Got that, my friends? Either you, the customer pays it, or the importer absorbs it, if they do not want to raise their price or if they have bandwidth in their margins. You would never know, really. That is the first problem. The tariff is usually just another element of cost in a pile of other erratic, variable and externalized elements of cost.

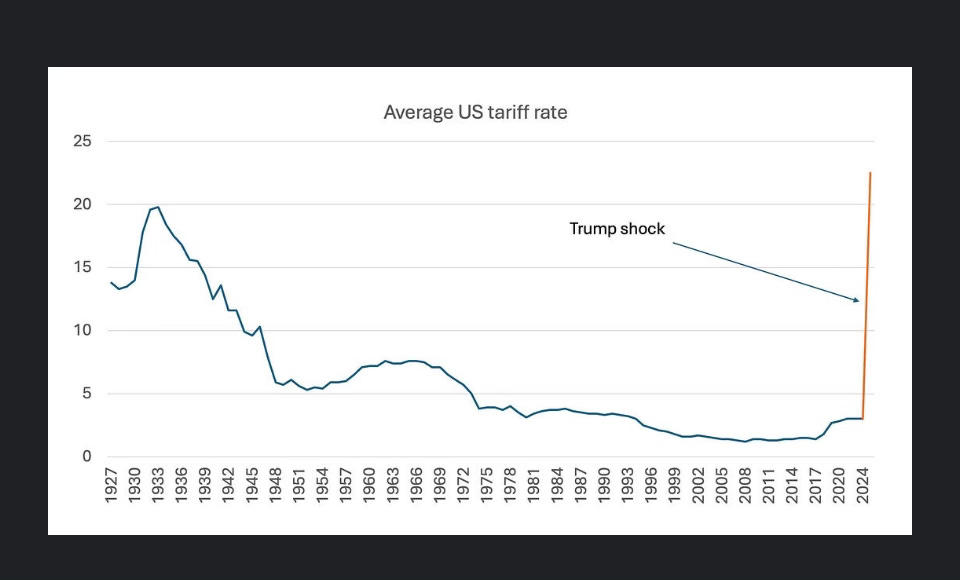

3. The Trump tariff calculations are all jacked up. The conservative, free market oriented American Enterprise Institute disentangled this, as did the economist whose model the tariff calculations were based off of. But the best explanation was by journalist and economist Jessica Burbank, and we encourage you to read through this link and subscribe to her stuff.

4. It is essentially economic shock therapy. Crashing the stock market is rough on working people; we don’t get the bailout like the too big to fail banks or heavy industries. Crashing the market intentionally is bonkers, even sociopathic. But not surprising for a professional grifter. While only 58% of Americans are invested in the stock market, 100% of our economy is wrapped up in it, including pensions and 401k’s, state and municipal funds, philanthropic endowments, etc. Crashing the market will shock jobs, livelihoods, cash flows. Along with the massive federal layoffs and cutbacks to vital public services being enacted by DOGE, we now know what economic shock therapy will feel like. It is kissing cousins to eugenics. The most vulnerable will feel it the worst.

Many countries around the world have been put through economic shock therapy when lenders or financiers wanted to force free market disciplines on their society, such as lowered trade barriers, export economies (to make cheap shit for American and European consumers), mass layoffs and wage cuts, liquidating public pensions, selling off public assets, all in order to make them riper for investment by American banks and corporations. This could even involve the use of death squads, disappearances and other less savory practices. Mexico, most of South America, especially Argentina, most of Africa and a good portion of Asia (except China, but that’s a long story), as well as Greece more recently, have all been put through economic shock therapy in one form or another in recent decades. If you are a financier or investor or asset manager, you love this shit, it means a big payday eventually once the markets ripen and your assets appreciate. If you work for a living, saved for retirement, are dependent on public services or are otherwise a member of society, it mostly sucks. But congratulations, my fellow Americans, we will soon relate to the experience of billions of other humans who went through this economic shock therapy.

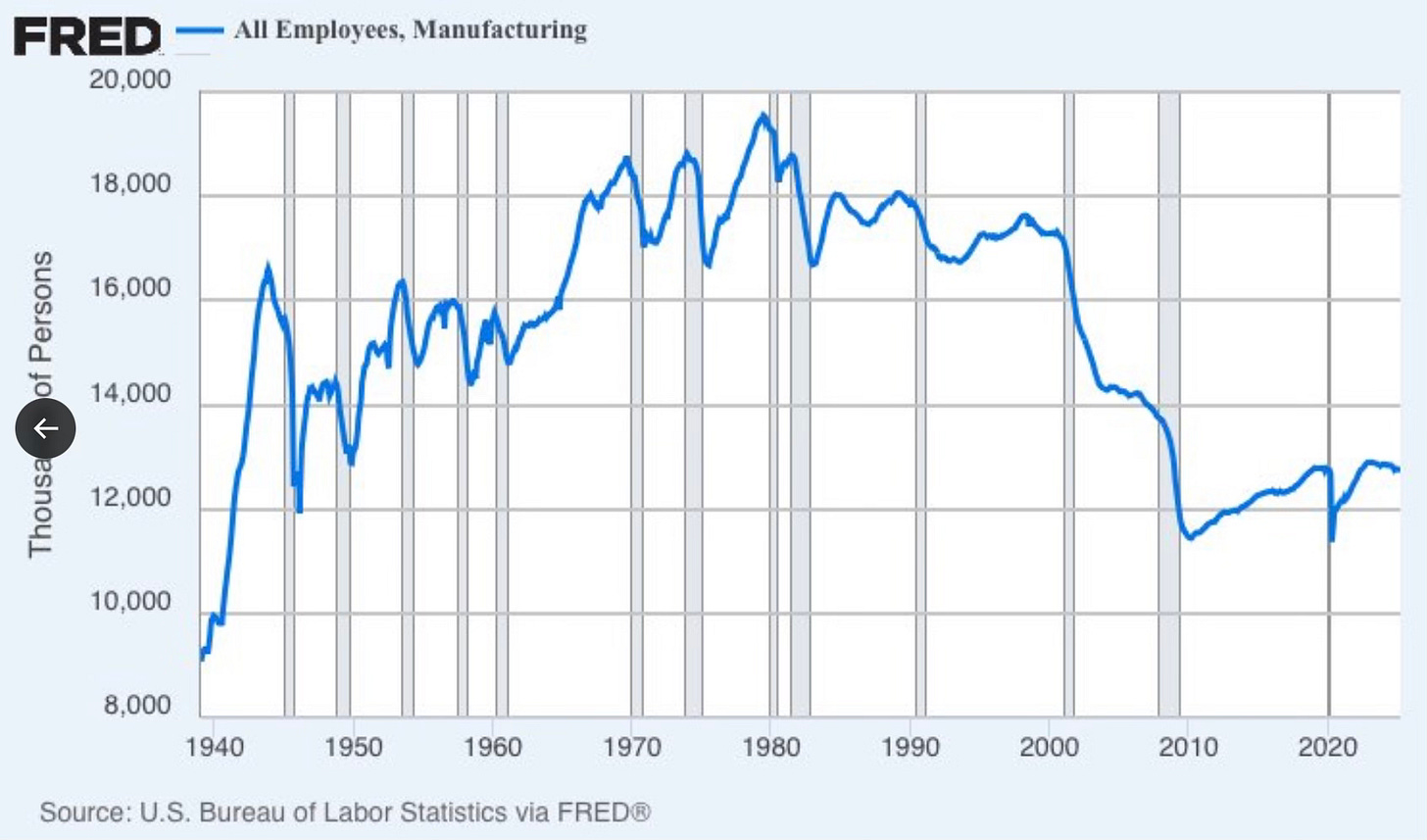

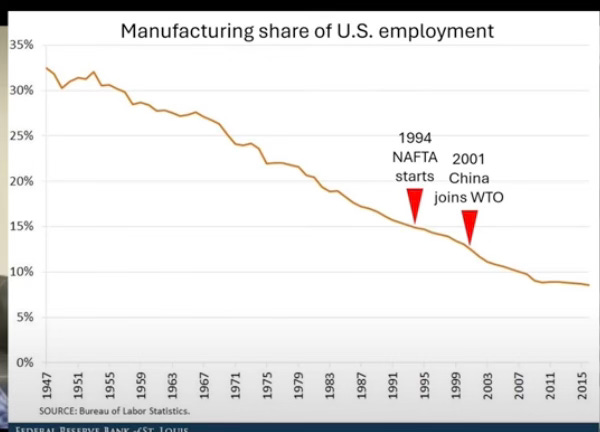

As is often the case with populist policies, there are legit grievances and rationales for increased tariffs. Back in the 1990’s and 00’s, I came of age getting tear gassed and arrested at anti-globalization protests, joining millions of others who opposed Bush/Clinton/Bush policies that would offshore millions of good paying manufacturing jobs, cratering entire industries and communities and changing the economic fabric of our lives. (Hence, why I went into the service industry. Respect to all the service workers. High five, y’all.) But the right wing populists were there too, long before their Tea Party stuff, also opposing globalization and they never let up. So here we are.

6. In the 90’s and 00’s, Bush/Clinton/Bush were just the latest butchers of the middle class. The trend to deindustrialization started earlier, in the mid-50’s and accelerated in the 60’s and 70’s. The loss of manufacturing jobs and the growth of the service sector and consumerism were major historical trends that undergirded pop culture and politics, as much as the Vietnam War did or more, even before globalization became a catch-all for it. The advent of both rock and roll in the 50’s and hip-hop in the 70’s, the explosion of hippy-free love and outlaw biker culture in the 60’s, the success and defeats of the Civil Right movement in the 60’s and 70’s, the long implosion of Appalachia and the Upper Midwest into the Rust Belt, and the subsequent hollowing out of the highly unionized manufacturing sector, were all results of this long term, bipartisan trend towards free trade globalization and American deindustrialization. It is a tragedy of world historic proportions. We used to make shit here.

7. To his credit, Trump has always been consistent about tariffs and protectionism. It doesn’t mean he is correct though, since much of the shared domestic wealth generated by manufacturing was the result of high trade union density in that sector. Before unions stepped up in the 1930s, manufacturing jobs were low wage hellscapes with frequent deaths and injuries, i.e, the Triangle Shirtwaiste factory or the brutal auto industry pre-UAW. But since the 1980’s, Trump has echoed a particular understanding of tariffs and domestic industrial development as the path to national prosperity that is common among certain populists. Joel Salatin, who inherited several hundreds acres of prime farmland and became a celebrity farmer, has said similar things about tariffs. Ross Perot, Pat Buchanan, too. They were adept at tapping into the post-industrial grievances of working people who would never experience the prosperity of the post-war years and instead redirected their anger at women, people of color, LGBQTIA folks, immigrants, the disabled, almost all of whom were working people who would also never experience the prosperity of the post-war years. The ideas that strict borders, firm gender roles, strong tariffs, and maybe just a little bit of that pre-Civil Rights-era white supremacy, would bring back prosperity and strong, manly manufacturing jobs that those woke, coastal elites sent overseas and replaced with this financialization and the service sector. This tariff business didn’t come out of nowhere, as scatalogical as it may seem. It is ideological.

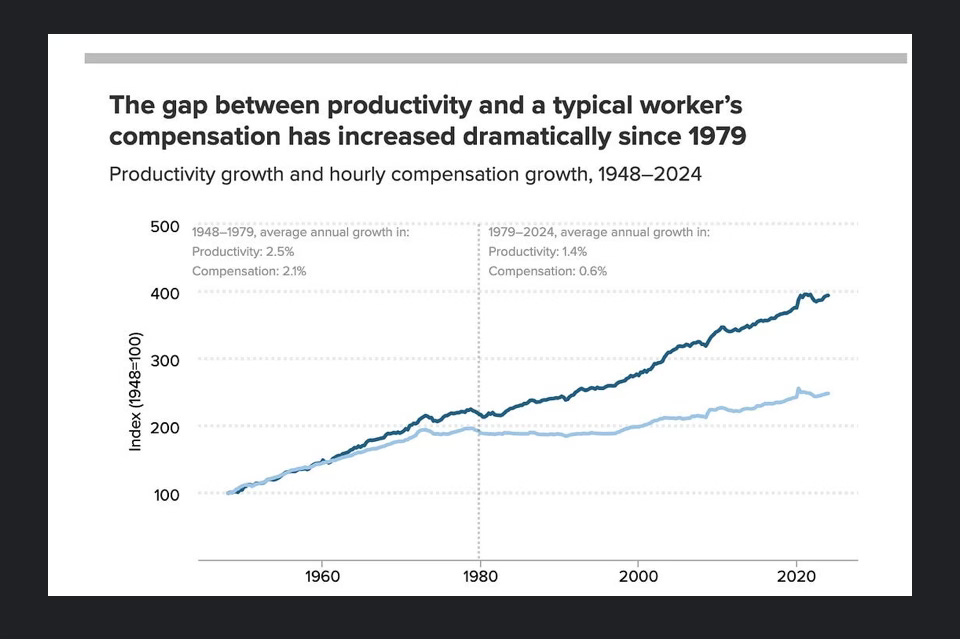

8. But the winners of globalization weren’t the people of every country that is now exporting products to the U.S. China may be a really big economy that has eliminated the worst forms of poverty, has huge high speed rail and modern infrastructure like Chongqing and Shenzhen, and may soon even have flying taxis, but their highly skilled workforce still makes a fraction of what most Americans do, has few social safety nets (not counting the suicide prevention nets along the walls of iPhone manufacturer Foxconn), and major environmental issues. Hence, why they can make and sell us so much cheap stuff. Likewise to an extent, Vietnam or India. The big winners were the investors, the asset managers, the speculators, the bankers, the executives who reaped the rewards of lower labor costs, lower environmental regulations, lower prices and higher sales volumes, year after year after year, decade after decade, to create enormous profits, peaking in the pandemic, where profit margins and shareholder buybacks hit historic highs, while real wage growth stagnated. The gambit had been that Americans could buy unlimited, cheap, imported consumer goods, despite an ever diminishing purchasing power due to inflation, and a huge gap between their labor productivity and compensation. Over $75 trillion, according to RAND, or $3.9 trillion a year. We can’t blame Vietnam or Laos or South Africa for that gap. Trump and his ilk have been cashing in for decades, and are now using tariffs as a bait and switch. A shell game. Another con. We are all marks.

9. Tariffs can absolutely be a relevant and rational part of trade policy and industrial development. All prosperous, developing nations have used tariffs at one point or another, including the U.S., in order to protect domestic industries. To his credit, Biden’s various infrastructure policies, while deeply flawed, included targeted tariffs and stimulated a huge pick-up in construction spending in the manufacturing sector. Because much of this was earmarked for green energy and related industries, Don Cheeto and his cronies won’t be following through on it.

10. The current tariff regime is a shakedown, and a set-up to crash the economy and cash in. That is my thesis. Shock Therapy. Setting huge tariffs on products we cannot grow or make here is ridiculous, insane, and meanwhile, Trump’s USDA just killed $1 billion in local food infrastructure funding. Astronomically nonsensical tariffs on Sichuan peppers, Ecuadorian bananas, Vietnamese cinnamon, Madagascar vanilla, Italian EVOO, Thai rice, Spanish tuna, Cote D’Ivoire cocoa. It will be brutal on CPG brands and their suppliers. If they were serious about stimulating domestic manufacturing, this is how they should do it:

Decide which industries you want to protect and build domestically. Auto parts, apparel, consumer electronics, solar panels, California almonds, New Balance running shoes, etc.

Determine the market size, price thresholds, domestic productions volumes and annual growth rates to make the industry profitable and viable.

Set tariffs on these particular products that are being imported.

The tariff rate will be paid to the government and included in cost of goods by the importer of record and if it is high enough, it will raise the import’s consumer price above their comfort level, lower sales volumes and enable the domestic product to compete effectively, driving consumers to buy more of it and develop that industrial capacity. Or create public purchasing to stimulate demand for the domestic production. The government buys a lot of stuff.

Or don’t let relevant imports into the country. Set up customs checks. Hire more staff at ports and border crossings. Stop ICE from black-blagging farmworkers, and go after black market carburetors, almonds, sneakers. No more Nikes! Now you will buy New Balance (I prefer Brooks, btw).

This is a bit simplified, yes, but I am a grocery nerd, not an economist.

11. But that is not all. We also need industrial policy beyond just tariffs. This includes familiar topics such as antitrust, or creating a public grocery sector. Industrial policy became popular during the Covid-19 pandemic, when the Biden Administration and Congress committed public money to stimulate private industry and consumer spending and avoid a recession. Biden did great on some macroeconomic indicators, like GDP growth and Wall Street stock values, despite inflation and high interest rates. Household economics, on the other hand, have tanked since 2022 and the end of pandemic era benefits.

As I wrote recently, over one in three Black adults and nearly two in five Hispanic adults were food insecure in 2023, and over 47 million people lived in households experiencing food insecurity, an increase of 13.5 million compared to 2021. Poverty is up 65% since 2021, child poverty has tripled and 67% of Americans are living paycheck to paycheck. If wages had kept pace with productivity since 1975, Americans would have a $24 an hour minimum wage and be $75 trillion richer. Biden industrial policy enriched Wall Street and private industry while expecting long term patience from average Americans for the benefits to trickle down.

12. Instead, industrial policy should have included a few other things: Price controls on key household consumables, particularly high volume pantry items and commodities like eggs, bread and beef, that could have spared consumers the worst of inflation. In addition, requiring some form of public or common ownership of any subsidized or protected industry should have been table stakes, so that the gains could have been shared by a greater number of people, whether in the form of cooperatives, worker governance (like in Germany) and/or sectoral collective bargaining (like in Norway or Japan), employee stock ownership (like Publix), employee profit sharing or public ownership of subsidized industries. This would also prevent the growth of parasites like Elon Musk, who has received billions in public subsidies and ongoing public contracts to build his wealth. Such industrial policy is not on the table with the Trump team, far from it. Everything they are doing is just about enriching themselves and their cronies. I grew up in NYC, this is how they roll.

13. Tariffs instead will drive up consumer prices most for the people who can afford this the least, and add massive cost burdens to many innovative, emerging brands sourcing ingredients from abroad, while doing little to stimulate well-paying jobs domestically. A weakening U.S. dollar will make this even worse. Cheap consumer goods have been bread and circus for the working poor for the post-industrial era. But now that Trump is subcontracting out prisoners to El Salvador and ICE gestapos are kidnapping people off the streets, maybe they are more about the stick then the carrot, or as Trump told the press last week, “Take your medicine.”

Early estimates are $3800-4200 in additional tariff-related expenses per household, in a country that has seen food prices increase 31% in 5 years, and much higher in many categories such as beef, poultry, frozen potatoes, pet food, infant formula, baby food, snacks and yogurt. Demand in food is flat since 2019, food insecurity has skyrocketed. What will this scattershot tariff inflation do to consumer demand? Early estimates from industry peers assume an additional 5-8% price inflation off the bat. This is your art of the deal.

14. What does this mean to us, in the mighty but misunderstood grocery sector? As I said to the New York Times, “Consumers won’t know if things are priced correctly or they are getting ripped off.” It will be a shell game. Prices are certainly going up, even for domestic products.

Cardboard, cookware, packaging film, shelving and gondolas, box knives, packaging tape, spices, nutritional supplements, private label contract manufacturing, forklifts and pallet jacks, on and on and on, so much of the guts of our food system will be subject to this or that tariff. We used to make more shit here.

It means that pricing will be hard to anticipate and means consumer demand will be even more skittish. Uncertainty means you can’t forecast inventory. You can’t set prices to anticipate demand elasticities. You can’t plan as easily for demand ebbs and flows, and build promotional plans, category management strategies, or product assortments that meet consumer need states for sustainability, price/value, new tastes and trends, diverse suppliers, all the fun stuff that drives sales and traffic in grocery stores, especially those trying to compete with the mass merchants and private label everyday low cost discounters. It means supply chain hiccups, especially for “just in time”, profit driven, cash-starved supply chains that don’t have much flex when things get hectic. It may mean sku rationalization and stores cutting back on niche items and slow movers to emphasize lowest common denominator, private label and value tier items. Fun times ahead.

It is going to be a tough haul. Hang in there. Do your best. Look out for each other.

And. “The job of a citizen is to keep their mouth open.” -Brecht.

2. Albertsons Supplier Notice On Tariff-Related Price Changes.

Albertsons is the fourth largest grocery chain in the U.S., with over 2200 stores, nearly 6% total U.S, grocery market share, and in many metros, over 25% market share. This is a big deal. Letter printed below in full. Emphases are our own.

March 2025

Dear Valued Supplier,

As you know, recent developments indicate the possibility of the United States imposing tariffs on goods imported from several countries on or around April 2, 2025.

We understand this situation may raise concerns for your business operations and the ongoing relationship we share.

To maintain transparency and ensure consistency across our supply chain, we are writing to clarify our Company’s policy regarding how these tariffs should be handled in our ongoing partnership.

Our customers rely on us for competitive pricing and quality products, and we are committed to maintaining the value proposition our customers expect. Therefore, with few exceptions, we are not accepting cost increases due to tariffs.

Tariff Costs in Invoices

Suppliers are not permitted to include tariff-related costs in invoices without prior authorization by Albertsons Companies. Any invoices that include such charges without prior authorization will be subject to dispute and may result in payment delays.

Requesting Cost Changes Due to Tariffs

If the imposed tariffs result in significantly impacting your costs, per the terms of our existing contractual arrangements, with 90 days of advance notice, you may request a cost change for the goods supplied.

To do so, please follow these guidelines:

• Submit a formal request: Complete ACI required cost change forms for your cost structure and the proposed cost adjustment. Provide a detailed explanation of the tariff impact and you must specify the harmonized tariff schedule (HTS) code and country origin of each commodity impacted.

Include supporting documentation: Attach relevant documentation such as tariff notices, import duty receipts, and any other evidence supporting the need for a cost change.

• Lead time for approval: Allow a minimum of 30 days for the review and approval process once the request is submitted.

Your regular ACI point of contact will review requests on a case-by-case basis. Approval is not guaranteed and will depend on factors such as contract terms, market comparisons, and overall supply chain impact.

Other Important Considerations

• Advance notice: Please notify us promptly if you anticipate any delays or disruptions in supply due to changes in tariff regulations.

• Communication: Maintain open communication with our team to address concerns or questions about tariffs and their impact on our partnership.

• Compliance: Ensure that all tariff-related adjustments that are approved comply with U.S. regulations and policies to avoid any legal or financial complications.

We value our supplier relationship and appreciate your cooperation and understanding as we navigate these potential changes together.

As more information becomes known about U.S. imposed tariffs, we will provide additional information and direction.

If you have questions or concerns, please reach out to your regular ACI point of contact.

Thank you for your continued partnership in our pursuit to earn customers for life.

Albertsons Companies, Inc.

3. Tunes.

Joey, Johnny and crew make shock therapy sound so fun.

peace.

Another excellent spot on no bullshit article.