Grocery Update #17: How Grocery Cartels Created & Profited From Price Inflation

Big Food, Big Problems.

Discontents: How Grocery Cartels Created & Profited From Price Inflation.

Fact: Grocery prices are up 30% since 2019. (Source: NIQ).

Fact: Grocery unit volumes are flat or down in most categories since 2019.

Fact: 65% of all grocery sales are controlled by 6 companies. (Source: Numerator).

Inflation was a direct result of market concentration, and the pricing power of large firms across all sectors of the food supply.

The Demand Curve

One of the central arguments against the idea that inflation was caused by profiteering in highly concentrated industries was that consumer demand spiked. The iron laws of supply and demand drove prices up due to shortages during Covid-19. This is an article of faith, especially for some economists. The problem with this idea, especially in the grocery industry, is that the data just does not support it.

Demand spiked briefly in the months after lockdown in 2020, when the food service sector shut down and supply chains buckled under the pressure of pandemic hoarding. And then the Federal Reserve pumped over $4 Trillion into the economy, juicing capital markets. Most grocery categories then saw a significant slowdown in demand over the next 4 years. Consumer packaged goods (CPG) price hikes, passed on to consumers by wholesalers and retailers, drove up inflation. CPG price increases outpaced the rate of inflation by several points from 2021-2023, with the gap increasing as the CPI (the main measure of inflation) slowed down.

This simple fact, that demand is down in many categories, disproves widespread misinformation about inflation that gets repeated ad nauseum. In the wake of a recent Democratic presidential campaign promise to ban price gouging- a policy that is designed in line with current state level regulations on price gouging- it is important to know the actual data. As a grocery professional with a background in category management, merchandising and assortment planning who built up a $5 billion P&L (profit and loss) through the smart use of data, I feel that economics should be grounded in MATH, not dogma. Call me a pragmatist. Call me a materialist.

So to summarize: Demand did not drive up prices. Demand is down. Prices are up due to the profiteering enabled by excessive market concentration.

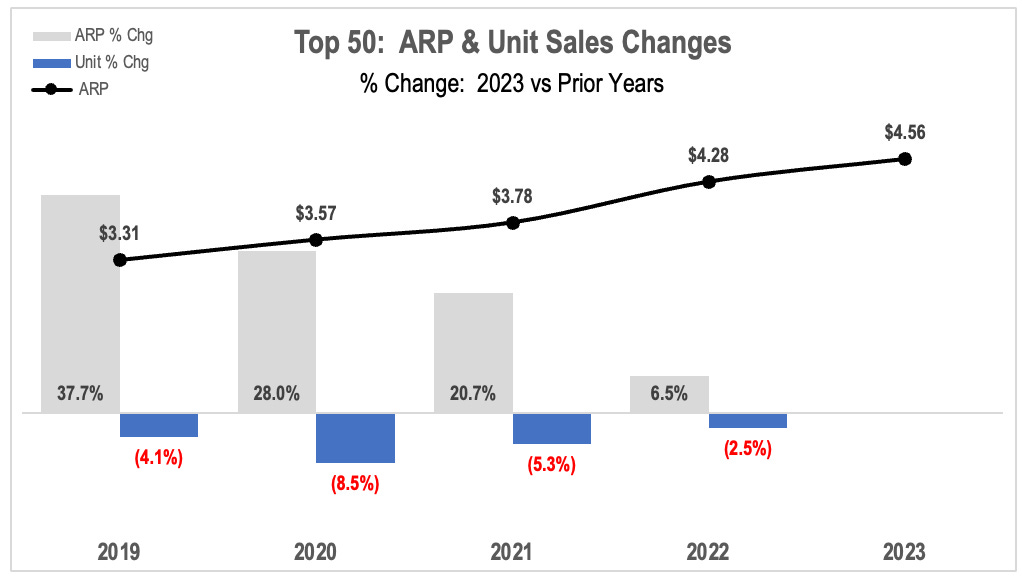

Top 50 grocery categories: Price (ARP/average retail price) vs. unit volume trends:

Data: 2019- 2023 via NIQ, Circana.

Grocery sales up 38%, units down 1.6% and prices up 40%

Dairy sales up 33%, units down .1% and prices up 33%

Meat sales up 27%, units down 10.5% and prices up 41.5%

Frozen food sales up 37%, units flat at 1% and prices up 35.6%.

Household goods up 24%, units down 11.4% and prices up 40%.

Pet food sales up 40%, units down 7% and prices up 50%.

Produce sales up 24.5%, units up 2% and prices up 22%.

CR4: The Measure of Market Concentration

CR4 is an easy measure of market concentration. Market abuses such as price fixing, price gouging and wage fixing are likely to occur when the top four firms control more than 40%, known as CR4.

Nearly every food and ag sector exceeds CR4. From head to toe, snout to tail, seed to shelf, our food system is just too concentrated. Nearly everything we eat, buy and sell exceeds CR4 of 40%. The food industry is run by cartels, at all levels of the supply chain.

The top 6 chains control 65% of grocery retail nationally, the top 4 over 50%. Walmart. Kroger. Albertsons. Ahold-Delhaize (i.e. Stop&Shop, Food Lion).

Grocery retail is also heavily consolidated on a regional basis. In Salt Lake City, Portland and Seattle, the top 2 control 50%. In Chicago, the top 3 control 50%, in Southern California the top 2 control 40%. In Detroit, Atlanta, DFW, Arizona and Denver, Colorado, the top 3 control 60%. In Houston, the top 3 control nearly 70%. In Austin, the top 2 control 75%. Walmart alone has over 60% market share in dozens of metro areas. And in all cases either Walmart and/or Kroger are in 1 of the top 2 slots. It should be no surprise then that the number of grocery stores has declined by 30% in the last 25 years.

Four or fewer corporations also control 93% of soda sales, 80% of candy, 75% of yogurt, 72% of breakfast cereals, 60% of snack bars, 66% of frozen pizza, 60% of bread, 80% of toothpaste and 80% of toilet paper sales.

Bottled water, the top 3 have over 40% share.

Soda, the top 3 companies have around 90% of the market.

Cookies and crackers, top 4 with 60%, Mondelez alone is close to 40%.

Bread, top 2 with around 50% share.

Sliced cheese, led by Kraft Heinz at 65%.

Yogurt, top 4 companies at over 70% share.

Packaged salads, top 4 at over 50%.

Meat processing, top 4 at nearly 50%.

Baby food, top 3 at over 80%. Baby Formula, top 3 at 84%.

Cereals, top 3 over 70% market share.

Candy, top 3 over 80%.

Frozen french fries and tater tots, top 3 over 70%.

Now, let’s combine these two streams, inflation and consolidation:

Cheese up 28%, units up 6% and prices up 21%.

Sliced cheese, led by Kraft Heinz at 65% share.

Milk up 16%, units down 5.8% and prices up 23.8%.

Yogurt up 32%, units down 10% and prices up 47%.

Yogurt, top 4 companies at over 70% share.

Eggs up 58%, units down 6% and prices up 68%.

Cal Maine controls 20% of egg sales nationally.

Soda sales up 56%, units down 2% and prices up 59%.

Soda, top 3 companies have around 90% of the market.

Chocolate candy sales up 34%, units down 8% and prices up 46%.

Candy, top 3 over 80% share.

Water sales up 43%, units 1.6% and prices up 41%.

Bottled water: Nestle, Coca-Cola and Pepsi have over 40% share.

Coffee sales up 21%, units down 8% and prices up 31%.

Top 4 coffee companies have almost a 70% share.

Cereal sales up 17%, units down 12% and prices up 33%.

Cereals, top 3 over 70%.

Beef sales up 28%, units down 14% and prices up 50%.

Top 4, 85% of beef processing.

Chicken up 36%%, units down 3% and prices up 40%.

Top 4, 60% of poultry processing.

Pork and ham sales up 16%, units down 13% and prices up 34%.

Top 4, 67% of pork processing.

Baby food up 30%, units down 11% and prices up 45%.

Diapers up 22%, units down 11.7% and prices up 38%.

Formula up 17%, units down 3.3% and prices up 21%

Baby food, top 3 at over 80%. Formula at 84%, top 3.

Bread up 36%, units down 3% and prices up 40%.

Bread, top 2 with around 50% share.

Cookies and crackers up 28.8%, units down 8.2% and prices up 40%.

Cookies and crackers, Mondelez close to 40%, followed by Kellanova (Mars) and Campbells.

Fresh potatoes up 35%, units up 3% and prices up 31%.

Potato Chips up 38%, units down 3.5% and prices up 43%.

Frozen potatoes (fries, tots) up 89%, units up 14% and prices up 65%.

In 2022, the 4 companies who control 70% of French fry production, (Lamb Weston, Simplot, McCain and Cavendish) raised prices within a week of each other. French fry prices have increased by 65% since 2019.

Concentration disrupts markets like black holes warp gravity.

Walmart is the supermassive black hole at the center of the food system, devouring all in its wake. Big CPG companies exert outsized influence, like huge stellar masses. There is no free market in food. The laws of supply and demand… irrelevant?

Profiteering.

This analysis would not be complete without a brief overview of profit taking.

Beef, pork and poultry prices made up the largest chunk of price increase in late 2021 and early 2022, when prices spiked the most quickly. Four conglomerates control up to 85% of these markets and in that same timeframe, their profits surged by 120% and net income by 500%, making more money off meat while selling less of it. The Big 4 paid out over $4 billion in shareholder dividends in the first 2 years of the Covid-19 pandemic, while 59,000 meat workers fell ill and 300 died working in plants sped up by a Trump executive order. In Q1 2022 alone, Tyson posted over $1 billion in profit, up 48%, while beef prices rose 23%.

In July 2021, Pepsi announced its first major price increase of 5%, enabling $8 billion in net income and over $5 billion in shareholder dividends by early 2022. In the same timeframe, Coca-Cola raised prices, leading to a 15% net income increase from 2020-2021. Pepsico then increased prices again and again and again. In 2023 Pepsico took in $91 billion in revenue, up 35% since 2019, while repurchasing $7.7 billion in stock.

The price hikes continued throughout 2022, with Coca-Cola, Hershey’s, Pepsico and Mondelez surpassing earnings forecasts. Mondelez profits increased by $800 million and issued $4 billion in shareholder payouts. Across the board price increases at Proctor and Gamble, maker of Tide and Bounce, brought in $14.7 billion in net earnings and paying out $19 billion to shareholders. General Mills increased prices 5 times in 2021-2022, Q4 2022 profits increased 97% to $823 million with $2 billion in shareholder payouts. The CEOs of Pepsico, Mondelez, Conagra, Kellanova and Kraft-Heinz all bragged to shareholders again and again that they were able to raise prices to boost revenues, sometimes expressing surprise at how “resilient” their customers were in tolerating these price hikes.

Profits in 2023 for Nestle were $13 billion, for Coca-Cola, $10 billion, Pepsi, $9 billion, Unilever, $8 billion, Mondelez, $5 billion.

There is nothing inherently wrong with profit. A business must generate a profit to survive. The problems are always how it is made, who gets it and how it is shared. These were gains that could have instead been invested in lower prices for consumers or higher wages for workers.

Further back in the supply chain, just 4 companies control 70% of the global grain trade, affectionately known as ABCD; ADM, Bunge, Cargill and Dreyfuss. ADM saw double digit net income increases and Cargill saw $5 billion profits off of $134 billion in revenue, making it the largest privately held food company in the world. Over 4700 Covid-19 infections and 25 deaths occurred at Cargill facilities.

Now let’s talk retail. The CEO of Kroger stated that they operate best at 3-4% annual inflation. This would add up to over 15% compound inflation since he made that statement in 2021. The CEO of Albertsons justified higher prices because he figured customers would keep buying more food while the economy was growing and they had pandemic-era benefits to spend. Both companies, with a combined 16% grocery market share, raised prices well above the rate of cost increases. This was admitted under oath during the Kroger-Albertsons merger trial the week of August 26th, 2024.

Between 2019 and 2022, Walmart raised prices on thousands of items well above the rate of inflation, including potato chips by 35%, cookies by 62% and yogurt by 92%. Prices at Albertsons on store brand oils increased by 117%, potato chips by 68% and packaged cheese by 125%.

Kroger, Albertsons, Target and Dollar General all saw double digit net income growth from 2020-2021. Walgreens income growth hit triple digits with all the pandemic pharmacy traffic and Ahold-Delhaize increased net income despite sales declines. In 2020, Walmart and Kroger saw windfall profits as the economy shut down, adding $45 billion to the Walton family wealth and 2 billion dollar rounds of Kroger stock buybacks. The Mars family added $21 billion to their fortune from 2020-2021. Food and agriculture billionaires added $400 billion to their wealth from 2020-2021, with Covid-19-related food inflation creating over 60 new food billionaires.

In 2021, food company profits growth outpaced wage growth by 671% at Albertsons, 333% at Amazon, 83% at Keurig-Dr.Pepper and 55% at ADM. Likewise, profit gains outpaced revenue gains by 17 times at Albertsons, 4.5 times at Kroger and 3.5 times at Target, while CEO pay topped nearly 1000 times the average employee compensation, a factor that rarely weighs in on inflation conversations, particularly at retail companies that pay far less than a living wage.

Stock buybacks as a percent of profit were 38% at Walmart, 52% at Target, 117% at Dollar General and 50% at Kroger. If corporate boards had seen the light, they could have instead raised wages by 112% at Dollar General, 50% at Target, 18% at Walmart and 12% at Kroger. Walmart alone could have funded living wages for all of its employees just with two thirds of its profits from Q3 2020-Q3 2021. Instead, the Walton family, who controls 46% of Walmart stock, pocketed billions.

Shareholders favor conglomerates with large market shares because they can raise prices and retain customers. This is called a price-profit spiral.

Profit margins crested at 15.5% in 2022, the highest since 1950, while corporations issued over $300 billion in stock buybacks. Profits hit a record $2 trillion in Q3 2022, coinciding with the highest rates of food inflation. 2021-2023 were the most profitable years for big business since the post-war 1950s.

Over 53% of price increases from 2020-2022 were driven by profit margin gains, with wage increases responsible for under 8% in that timeframe. This is not a fringe theory. The IMF, European Central Bank, the OECD and the European Commission all published major studies.

Adam Smith saw this even as far back as the 18th century, “Our merchants and master-manufacturers complain much of the bad effects of high wages in raising the price. … They say nothing concerning the bad effects of high profits. They are silent with regard to the pernicious effects of their own gains.”

This is Robin Hood in reverse, cutting checks to shareholders out of the pockets of consumers who are paying ever higher prices. The hysteria around price gauging bans is just gaslighting. Consumers check their receipts or their order history in delivery apps. They talk with each other and they comp shop multiple outlets to find the best prices. They know they have been getting ripped off. For years, the food industry and the media hyped up supply chain disruptions to use as a cover for price hikes well above the rate of cost inflation. And now, like naughty toddlers, the food cartels have been caught with their hands in the cookie jar.

What’s The Plan, Uncle Sam?

Over 80% of voters want to see lawmakers crack down on price gouging.

Over 50% of voters think that antitrust laws should be used against price gouging and price fixing to fight inflation.

The Harris price gouging plan would “crack down on unfair mergers and acquisitions that give big food corporations the power to jack up food and grocery prices and undermine the competition that allows all businesses to thrive while keeping prices low for consumers”. It includes a federal ban on price gouging on groceries, setting “clear rules of the road to make clear that big corporations can’t unfairly exploit consumers to run up excess profits” and give the FTC and state attorneys general new authority to investigate and impose penalties on companies. The policy announcement comes on the heels of a recently announced FTC inquiry into high grocery prices and the ongoing FTC lawsuits against the Kroger-Albertsons merger.

The Harris plan does not call for price controls. The plan instead connects the dots between price spikes and concentration, “Extreme consolidation in the food industry has led to higher prices that account for a large part of higher grocery bills”.

The Harris plan would give the FTC $1 billion to supercharge this effort, expanding the agency’s reach and ability to impose stiff penalties on violators. This is great news because under the leadership of Lina Khan, the FTC has been the most effective and impactful federal agency on behalf of workers and consumers.

Most Americans live in states that already have price gouging bans in place. But only state attorneys general have the power to take action. They have jurisdiction challenges reining in multinational food companies across state lines. It is in line with language in a draft bill by Senator Elizabeth Warren (D-Mass) that would also be in line with laws in 37 disparate states like Texas, California and New York. The Harris plan would also be limited to companies over $100 million in revenue, so small and emerging brands would not face the level of scrutiny as bigger incumbents. Regional and local grocery chains would not be targeted because they do not run afoul of “extreme consolidation” concerns.

The price gouging ban builds on this last theme, probably the most important work done by the current administration to protect workers and consumers: reviving antitrust. In 2023, the FTC/DOJ issued new merger guidelines to strengthen merger enforcement. The FTC released a report in March 2024 detailing how grocery profits remained elevated from 2023 to 2023, with profit margins topping 7%. The FTC found that big corporations took advantage of supply chain disruptions to raise prices and generate record profits. And larger chains were able to better secure inventory through strict fill rate requirements or by threatening to fine suppliers.

Price gouging bans are popular because they ignore the economic orthodoxy based on simple supply and demand models, theories not based on empirical evidence, real world math or irrational human behavior. In a highly concentrated food industry, they act as a “poor person’s antitrust”, based on fairness, by addressing the balance of power in high stakes contexts, like a post-pandemic supply chain. Price-gouging laws protect against volatility and instability and ensure that consumers can afford enough food to eat. They are not price controls. Big companies that dominate markets already control prices. This just prevents the most flagrant uses of their power.

What else should be on the table?

According to the National Grocers Association, “The Government should be enforcing the Robinson-Patman Act, a key antitrust law that already exists, but has been ignored for decades as big chains unfairly wield their influence.” For decades after the New Deal, Robinson-Patman enforcement enabled a more diverse and competitive retail sector, one not dominated by a handful of oligopolies. RPA enforcement will make retailers compete on service and quality, not just who can secure the most inventory at the lowest costs, such as Walmart demanding 98% everyday low price fill rates at the expense of anyone else. RPA enforcement will create more opportunities for small and emerging brands who are hamstrung by national agreements between wholesalers and retailers and who are outspent on shelf by deep pocketed, incumbent CPG brands. It is no coincidence that the decades when RPA was not enforced saw the rapid expansion of Walmart, Amazon and Kroger and the vertical and horizontal consolidation of all levels of the food industry.

Most industry personnel have grown up in an era of minimal enforcement and are not trained to steer clear of business practices that violate Sherman, Clayton and Robinson Patman Acts. This culture can only be changed through training, education and accountability.

The Swiss government regulates the prices of nearly 25% of consumer goods, the highest in Europe, so that necessities are not subject to supply and demand. In 2022, Switzerland felt food inflation of under 4%, less than a third of the EU and US. None of the nightmare scenarios of hoarding, shortages, poor quality, capital flight, runaway inflation or the collapse of the entire grocery industry came to pass in Switzerland. The Bolivian and Hungarian governments also froze prices during the pandemic, helping stave off inflation.

International cooperation and locally managed buffer stock systems are possible for food staples and core commodities such as corn, rice, wheat and culinary oils. This could stabilize prices and ensure supply during crises. Good food should be a human right, and in order to accomplish that, governments need to hedge against market manipulation.

Publicly owned supply chains, including wholesale, manufacturing and even delivery/logistics, could enable alternate allocation methods, so that the private sector no longer monopolizes the food supply. Such public supply chains could also plug into existing retail and wholesale supply chains as an inventory backstop or pressure valve to help stabilize prices and supply.

Employee, worker and/or consumer ownership should be on the table, with transitions underwritten by federal funds so that more companies can do this. These popular, bipartisan approaches to ownership ensure higher wages, better retention, morale and productivity. Not perfect. But viable.

Windfall profit taxes have been implemented in India, the UK, Germany and the E.U. The U.S. government could claw back profits from the top food and beverage conglomerates and then cut rebate checks to consumers.

The U.S. government could make fresh produce free. The point of sale value of fresh produce is just over $80 billion a year. The U.S. spends $900 billion on the military every year. Fresh produce, subsidized at either wholesale or retail point of sale is very doable. If we want it.

The French government secured lower pricing pledges from 75 food conglomerates that make 80% of groceries.

A just transition is necessary for blue and white collar industry workers that would be impacted by major structural changes to the food industry. Antitrust enforcement will be disruptive and workers should not pay the price.

A 10 year just transition to industry-wide Good Food Purchasing Standards, developed and road-tested by the private sector and now embraced by the public sector. This includes more plant-based foods, worker empowerment, community impact and regional sourcing, climate-friendly production and animal welfare. While the market is slowly moving in this direction, consolidation is slowing it down, through slotting fees, category captains and trade spending that favors incumbent brands. Why not make good food standards status quo, with a reasonable window to build up the supply chains and manufacturing capacity?

More to come on all of these points.

Sources: (Note: Due to time constraints, I did not hyperlink each statement above to a source, but if readers need particular sources, drop me a line. My Forbes articles below are highly detailed with sources as well.)

1. https://farmaction.us/agriculture-consolidation-data-hub/

2. https://www.ftc.gov/system/files/ftc_gov/pdf/p162318supplychainreport2024.pdf

5. https://www.supermarketnews.com/consumer-trends/why-grocery-price-controls-aren-t-answer

6. https://www.theatlantic.com/ideas/archive/2024/08/economists-kamala-harris-price-gouging/679547/

7. https://www.commondreams.org/news/meat-industry-price-gouging

8. https://ilsr.org/wp-content/uploads/2024/08/ILSR_FactSheet_Robinson-PatmanAct.pdf

9. BIG Newsletter, by Matt Stoller. Please subscribe!

11. https://www.axios.com/2024/08/20/price-gouging-kamala-harris-communism-kamunism

13. https://www.washingtonpost.com/business/2024/08/16/kamala-harris-2024-policy-child-tax-credit/

19. https://www.levernews.com/big-food-big-profits-big-lies/

20. https://rooseveltinstitute.org/wp-content/uploads/2022/06/RI_PricesProfitsPower_202206.pdf

21. Covid-19 supply chain shocks. August 2021.

22. Inflation was not inevitable. January 2022.

23. Where do grocery prices come from January 2022.

24. How windfall profits were supercharging food inflation. May 2022.

25. How profit inflation made your groceries so damn expensive. September 2022.

26. Why the Federal Reserve couldn’t solve food inflation. December 2022.

27. How to make groceries affordable again. October 2023.

28. Why your groceries are still so expensive. February 2024

peace.

Outstanding analysis and recommendations. The Harris White House should offer you a job driving these. :)